Quite an erratic week left the Greenback with modest losses, in the context of a strong rebound in the Japanese Yen and declining US yields across the curve. Meanwhile, the BoJ and the FOMC meetings take centre stage next week, followed by the Nonfarm Payrolls.

The US Dollar Index (DXY) traded within a new consolidative mood around the key 200-day SMA in the 104.30-104.40 band. The Dallas Fed Manufacturing Index is due on July 29, seconded by the Consumer Confidence gauged by the Conference Board and JOLTs Job Openings on July 30. Next on tap comes the weekly Mortgage Applications measured by MBA along with the Chicago PMI, Pending Home Sales, the ADP Employment Change, the Employment Cost index and the FOMC meeting. On August 1, weekly Initial Jobless Claims are due seconded by the final S&P Global Manufacturing PMI, Construction Spending and the ISM Manufacturing PMI. Finally, Nonfarm Payrolls, the Unemployment Rate and Factory Orders will close the week on August 2.

The rebound in the second half of the week was not enough to spark a positive weekly close in EUR/USD, which ended the week around 1.0870. Retail Sales in Germany will kick-off the weekly calendar on July 29. The advanced Q2 GDP Growth Rate in Germany and the euro area is due on July 30 ahead of the flash Inflation Rate in Germany. On July 31, the Unemployment Change and the Unemployment Rate in Germany are expected, along with the preliminary Inflation Rate in the broader Euroland. The final HCOB Manufacturing PMI in Germany and the EMU will be published on August 1, followed by the Unemployment Rate in the euro bloc.

GBP/USD clinched its second week in a row of losses, slipping back below the 1.2900 barrier amidst renewed bets of an interest rate cut by the BoE next week. Mortgage Approvals and Mortgage Lending are expected on July 29. On August 1, the BoE will decide on interest rates, while Nationwide Housing Prices and the final S&P Global Manufacturing PMI are also due.

USD/JPY printed its fourth consecutive week in the negative territory impacted by recent FX intervention and speculation of a BoJ rate hike next week. Japan’s Unemployment Rate will be unveiled on July 30. Preliminary Industrial Production and Retail Sales are expected on July 31, seconded by Consumer Confidence, Housing Starts, and the BoJ meeting. Weekly Foreign Bond Investment figures come on August 1, followed by the final Jibun Bank Manufacturing PMI.

A dreadful week saw AUD/USD collapse to two-month lows near the 0.6500 support, just to gather some traction on Friday after nine consecutive days of losses. Flash Building Permits in Australia will be published on July 30. On July 31, the Inflation Rate, the RBA’s Monthly CPI Indicator, Retail Sales and Housing Credit are all due. Furthermore, the final Judo Bank Manufacturing PMI is due on August 1 along with the Balance of Trade results. Home Loans and Investment Lending for Homes will close the week on August 2.

The BoE’s Bailey speaks on August 1 along with MPC Pill.

The BoE’s Pill speaks on August 2.

The BoJ meets on July 31.

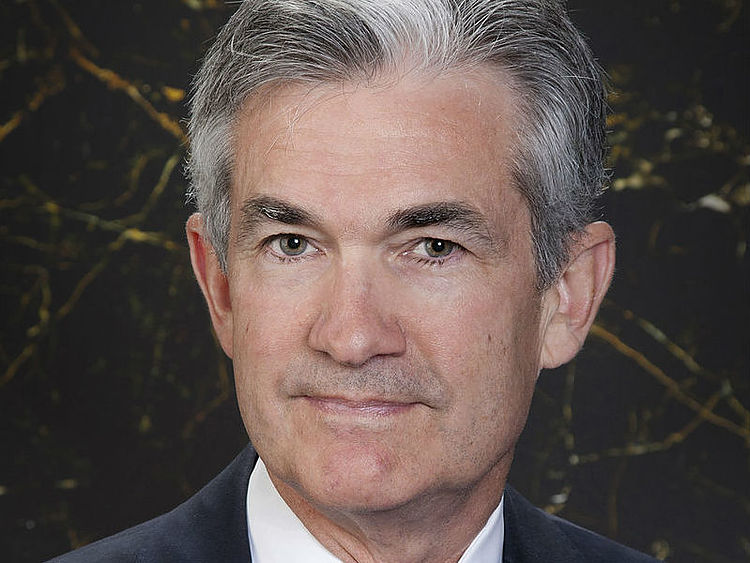

The Fed is seen keeping rates unchanged on July 31.

Share:

Analysis feed